Whether it’s for work or for fun, I spend a lot of my time on planes. However, I’m not doing long-haul in economy anymore. That doesn’t mean I’m paying over the odds for business or first class, though. As with everything to do with my travel journey, I’m finding the hacks to save money and maintain those luxury vibes.

One of the main ways I get to have a champagne lifestyle on a prosecco budget is by using travel credit card hacks. By getting to know the wonderful world of reward credit cards and the ultimate ways to stack your points, you’ll be able to get cut-price travel without having to dramatically increase spending. It’s all about being mindful of how you spend.

So, what is travel credit card hacking? What are the best programs and cards to get, and how does it all work? Don’t worry, I’ve got you covered with this ultimate guide to travel credit card hacking. Let’s dive in and learn more.

What Does Credit Card Hacking Mean?

Okay, first things first, what does credit card hacking mean? Despite the wording, it has nothing to do with traditional hacking or technological shortcuts. Instead, it means using your credit cards in the most efficient ways to get the most miles, points, and rewards for your everyday spending.

This is a huge section of the luxury travel industry nowadays. People who bounce around in five-star resorts and in first class largely aren’t paying full price anymore.

Instead, they’re either upgrading using points, purchasing sale-time flights with cards that’ll earn them back points, or gaming the system in order to meet a status goal.

There are dozens of ways to take advantage of the travel credit card industry. At its essence, it’s designed to drive loyalty, so to keep you coming back and spending, they’ll offer perks and rewards that you can earn over time.

However, plenty of people have worked out the quickest and cheapest ways to hit these goals. I’m one of them, and I’m here to share my knowledge.

There is a variety of credit card styles, reward program styles, and point collection and spending strategies. Some work better than others, and some may be more suitable for you than others. As always, stay within what’s reasonable for your financial situation!

I‘ve lived abroad for many years and love helping others find work abroad and figure out their “Move Abroad Plan.” Check out my class below to get you started ASAP!

What’s Better: Programs With Fixed Or Transferable Points?

One of the first things you’ll see when you start looking at loyalty card programs, whether that’s through credit cards, airlines, or hotels, is that there are fixed and transferable systems.

As you might expect, this means that the points earned can either only be used within the operators’ redemption portal, or you’re able to transfer them to other partners.

For me, transferable points are always preferable. You don’t know what kind of trips you’re going to be going for in the future, so locking into one set of airlines or one hotel group can be really limiting.

However, the plus point of fixed points is that you can usually earn and spend them a lot quicker. Redemptions tend to be lower as you’re locked into one system, but if that airline doesn’t go the route you need, then you’re kind of screwed.

With transferable points, you can move them around between different airline groups, hotel chains, and other partners. This gives you more flexibility, and often you’ll be able to snag redemption bonuses.

These kinds of transferable systems are usually led by credit card companies and banks. Sometimes they’ll have co-branded cards (more on that in a minute), but by and large, you’ll be able to earn cards on regular travel reward credit cards.

On the whole, transferable points are the best option. A lot of the time, you can transfer into the fixed systems, like Hilton Honors, for instance, and get a redemption bonus.

However, you should NEVER redeem directly from your credit card operator’s portal. It’s pretty much always the worst redemption rate for your points. Transfer it out to the individual brand’s portal and then purchase. You can thank me later.

Different Kinds Of Travel Credit Cards

Okay, before you dive in and apply for the first travel reward credit card you see, let’s go over the different types. They’re not all made equally, so you need to think about what’s going to work best for you.

Think about your usual spending habits, whether you already have brand loyalty to certain airlines or hotels, or whether you need to account for a business credit card or not.

Co-Branded

The first type of travel reward credit card that you might come across is a co-branded card. These are usually a collaboration between a bank and either an airline or a hotel chain. You’ll find a range of Delta and United co-branded cards pretty easily.

These often have specific points boosts for purchases made with this brand. For example, instead of getting two miles per dollar spent on travel purchases, if you have a Delta card, you might get 5x miles on Delta-affiliated travel purchases.

If you already have a cache of points in an airline frequent flyer system, it may be worth getting a co-branded card.

However, much like fixed-point systems, co-branded cards can tie you into one group of hotels or airline partnerships too tightly. It can make it difficult to earn points outside of spending with key brands, and you’re limited in where you can spend them.

General

The opposite of a co-branded card is a general travel reward card. These are cards that are operated solely by banks or card companies and allow you to earn into one central rewards portal. From there, you can spend or transfer points into individual company portals and use them in a wider range of places.

It can also be easier to build up your points with a non-branded card. While you might not get higher points bonuses for specific brands, you’re more likely to get higher sign-up bonuses and category-based bonuses.

This could be that you get 3x on gas spending, or 2x on all restaurants. Of course, being a travel reward card, you also tend to get a travel category bonus anyway.

I pretty much exclusively only get these more general cards. I don’t like being tied to specific brands because you’re limited by your routes and schedules.

I switch between continents quite a lot, so tying into a US airline when I frequently travel from Europe to the Middle East or beyond doesn’t really make sense for me.

Annual Fee vs Free Cards

When looking at travel reward credit cards, you’ll also see some that are free and some that have an annual fee. These fees can get pretty steep for some of the business card options, but you need to weigh them up against the reward bonuses.

Most of the time, the free cards will have low-level rewards, usually a mile for each dollar spent and a couple of category bonuses, usually 2x points for travel and restaurants. The welcome bonus will also be a lot lower. However, if you can’t commit to an annual fee, it’s a good way to get started.

However, a lot of the time, the increased welcome bonus for an annual fee card will pay for itself. For example, if the difference between the two sign-up bonuses is 20,000 points straight off the bat, and the annual fee is around $150-200, then that’s a great return for the cash paid.

Of course, fee-paying cards will have higher points bonuses for different categories, and there are usually more perks. This can be anything from lounge access to a complimentary upgrade each year, to a lower annual spend requirement to receive a free companion ticket.

It’s important to weigh up the cost-reward ratio before deciding between a free and an annual fee reward card. There are often multiple tiers of fee-paying cards, so look at the differences between them.

Sometimes the increased perks aren’t actually worth it year-on-year, and sometimes they are. It depends on your preferences and what you spend your money on day-to-day.

Business vs Personal

The final thing to look at when you’re trying to figure out the different kinds of reward credit cards is whether you need a personal card or a business one.

Business ones tend to have a lot of extra perks, as they expect you to be traveling for work and racking up expense accounts. However, you need to look at the eligibility criteria to see if you can apply.

Of course, even if you are eligible, the business-specific perks might not be relevant for you. Personal cards tend to have cheaper upfront annual fees, which is a bonus, but if you’re in a family business or self-employed, it might be worth comparing before you commit.

Of course, business reward cards may also have taxation implications, so check with your business manager or accountant before signing up, just in case.

Why Travel Credit Cards Are Better Than Cashback Cards

In the world of reward credit cards, there are two camps: travel credit cards and cashback cards. On the whole, if you’re looking for travel perks and free flights, the travel credit cards are going to be better for you.

You often get extra perks like TSA PreCheck, lounge access, and travel insurance with a travel credit card, alongside the point boosts.

A cashback card gives you dollars back on spending, rather than points. Of course, this is great, and you can offset it against your statement credit for further down the line, but the returns and redemption value aren’t as high.

If you want greater returns and prioritize travel as something you want to save for, the travel credit cards are a much better option

How to Earn Credit Card Points and Miles

Of course, one of the most important things to consider when trying to hit those free upgrade aims is how to earn your points and miles in the most efficient way. There are so many ways to earn points, and some are definitely better than others.

Sign-Up Bonuses

The best and quickest boost to your points pot is a credit card sign-up bonus. Pretty much all travel reward credit cards will have them. I’ve seen them as high as 100,000 points for some high annual fee cards on offer, but on average, they range anywhere from 20,000-40,000 points.

This, of course, depends on whether you’re on an annual fee card or a free version. As you might expect, the free versions usually have lower sign-up bonuses. So, do the maths and see if it’s worth upgrading to the paid version for the welcome bonus.

Usually, the way that the sign-up bonuses work is that you have to spend a certain amount on your card within the first three or six months. On the whole, I’ve seen this requirement as low as $1,000, but a lot of the time, it’s more in the $3,000-6,000 band.

What I’d recommend is waiting until you know you’ve got a big event like a wedding, a large vacation, or you need house furniture, before getting your card. That way, you’re not spending more than usual to hit this limit. Remember, we’re trying to save money here overall!

For that period, put everything from your groceries to your utilities to your Ubers on this card. Many of us easily spend $3,000 in three months just on living expenses, so it’s not as hard to hit as you might think; it’s just that you have to switch all your spending to this card to get those points and hit that minimum requirement.

Spending

One of the key ways to earn credit card miles is through spending. This is the traditional way to get points, whether you’re on a set brand loyalty card or a travel reward credit card. However, we’re not satisfied with one point per mile. Here are some of my spending tricks.

Airlines

Of course, if you’re looking at a co-branded credit card, airline spends are going to be a category with high point rewards. I’ve seen as high as 7x points for certain airlines and fee-paying co-branded cards.

However, even if you’re not co-branded, there are often boosted points on offer for travel and transportation as a category. A lot of the time, you can get two or three times the miles for booking with an airline, which is an easy way to boost your cache of points.

Other Set Categories

Most credit cards will split spending into categories. Not only does this help with budgeting because you can see where you’re overspending, but it also allows you to get extra points and miles.

Each category, such as travel, restaurants, entertainment, transport, groceries, and more, has points bonuses assigned to it. Sometimes it’s just a 2x bonus, sometimes it’s like 5x.

Each card is different, so when you’re comparing cards, think about your own spending habits and find one that best rewards them.

For example, if you live in the middle of the city, and there’s a high points bonus on gas, this isn’t super useful. However, if the card rewards Uber and public transit (which many do), then this is going to work in your favor.

On the whole, there will also be an “all other spends” category, which returns the flat one point per dollar spent. This obviously isn’t amazing, but it is better than nothing for those miscellaneous expenses.

Shopping Portals

Another great way to boost your point earning is by using shopping portals. Pretty much every reward credit card provider has one. Essentially, it works a lot like a cashback app. You log in, find the store you want to shop at, and then click through the link and get boosted points based on your spend.

The bonuses per store do change quite a lot, so sometimes it’s worth putting an alert on for certain stores to see if the bonuses go up. These boosted portal points are in addition to any category point bonuses, too.

So, for instance, if you’re booking a hotel stay through the shopping portal and the brand has 3x points, and then you have a further 2x points for travel spends generally, you’re getting 5x the points overall.

Voucher Portals

Voucher portals work similarly to shopping portals, except they allow you to purchase vouchers with points bonuses. This is especially great around the holidays when you’re looking for last-minute gifts.

So, say you want a $20 gift card to Nordstrom, you can buy the voucher through the shopping portal, and instead of just getting one point per dollar, there might be an offer for 4x points.

It’s good to take advantage of the boosted voucher offers while you can. If it’s a store or business that you know you’re likely to use in the future, like Walmart or Target, it’s worth stocking up on vouchers to get those bonus points.

However, remember that if you’re doing all your spending on vouchers, you’re not getting the category points for your credit card, so weigh up the benefits.

Surveys

While it’s not the most glamorous way to boost your points, some credit card companies, like American Express, allow you to fill in surveys for extra points. Virgin Atlantic used to have the same system, but for some reason, it has now stopped doing it.

Essentially, you get a number of points for each survey you fill in, based on the amount of time it takes to complete. While you’re not going to get an upgrade on doing surveys alone, it’s a great way to boost your pot if you have a spare half an hour in the evening or on your daily commute.

It’s completely free to do, and could push you over the edge to being able to afford that next level of upgrade. Instead of scrolling on Instagram or sitting around waiting for your food to cook, tick off a few surveys and inch closer to your points goal.

Referrals

Sometimes you can get points bonuses from referring new customers to the credit card operators. There will be different reward tiers based on the price of the product they sign up for, but it can be an easy way to get more points if your friends and family are looking for a new travel reward card.

It’s worth mentioning that usually both parties will get a boost, but not until after the first three months have been paid off. So, if you need to get points quickly, this isn’t the best option. However, if you’re still in the points building phase, it’s a great way to get more points without spending anything extra.

Redemption Bonuses

One of my favorite bonuses to look out for is a redemption bonus. This is partially an earning bonus and partially a spending bonus, because you only get it when you’re about to transfer your points to a specific vendor.

These aren’t available all the time, so it’s worth signing up for your credit card’s newsletter to hear about it first. Essentially, redemption bonuses work by giving you an extra few percent for choosing to transfer your points into that business’s account.

For example, in the Amex portal, you might see that Hilton is offering a 25% redemption bonus for a week if you transfer the points to the Honors system and book that way. As we know, you should always transfer points to spend them to get the best deals, and this is one of the reasons why.

In this instance, you’ll save 25% of the points you’d usually spend on the vacation. This can be a huge chunk of your points pot that you can reserve for your next trip. Redemption bonuses are a game-changer, and if you can time your purchase right, it can save you huge amounts of money.

Point Stacking

Finally, a quick word on point stacking. I’ve previously mentioned this, but it’s worth reinforcing, as it’s one of the main ways that influencers and points aficionados get their free flights and upgrades so quickly.

Points stacking is literally just piling multiple earning methods on top of each other to maximize the points return. So, you could use your travel reward credit card to purchase a voucher that you then spend online through the shopping portal.

Or even just stacking twice by using your credit card on the shopping portal gives you double the returns for the same purchase.

For example, say your reward credit card gives you 2x points on shopping. On the shopping portal, Sephora has a 4x points bonus. Maybe you buy a basket worth $50. Instead of just getting the 100 points from using your card, you’ll get 300 points for the same items.

Some shopping portals are a bit funny about giving you points bonuses if you spend using a voucher, but it’s always worth checking the small print, as it’s not always the case. If you’re able, this is a great opportunity to stack even more.

Using the same Sephora example, maybe you only get 1x points on miscellaneous purchases, like vouchers. However, buying the $50 voucher might have a 3x bonus.

Add that to the 4x shopping portal bonus, and you’ve got a total of 400 points for that same purchase. It’s all about being mindful and thinking about the best way to purchase because you click buy.

How to Spend Your Points

Okay, now let’s get into the fun bit – actually spending your points! There are a few different ways to spend your points to make the most out of luxury travel, so we’ll go through each option individually.

Transfer

First, you can transfer your points or spend them directly in your card’s portal. Always transfer them for the best returns. This is the whole point of not being tied to a fixed system: you can transfer them into the individual systems later.

In the transfer process, you might find redemption bonuses. These can help you save more points and get more for your miles. However, be aware that some point transfers go through quicker than others, so don’t leave it until the last minute!

Upgrades

One of the most popular ways to use points is to use them for upgrades. Obviously, you purchase a base rate economy ticket and then use your points to bump yourself up to business or first class. This often uses fewer points than trying to get a points-based business or first-class ticket.

However, it’s worth mentioning that you will have to pay the difference in taxes and fees between the economy ticket and the class you end up in. Depending on your departure location or destination, these can be pretty high.

Free Flights

Of course, the dream is to get a free flight with your points. This is rarely actually the case, as you still have to pay taxes and fees. However, it can be a whole lot cheaper than normal.

Most airlines are operating on dynamic pricing models for their points now, which means it’s possible to get cheaper business and first class tickets on certain flights. Before, it was a set amount for each route and rose during peak season.

It’s worth looking at your individual airline reward seat finder to find the cheapest option, or use tools like point.me to figure out the cheapest option for your desired route and ticket class.

Vacations

You can also use your points to book entire vacations through airline package systems. Overall, I’d avoid this, as you can often make your points go further by splitting them between airline redemption for the flight and the hotel chain option for your accommodation.

However, some airlines have points offers for resort vacations at certain times of the year, so this can be a cost-effective option.

How to Work Out If Your Redemption Trip Is Worth It

Okay, one of the biggest questions that I get when talking about points is: how do you know if the redemption is worth it? After all, you’ve worked long and hard to build up your points, so you need to know if it’s actually worth it!

Luckily, there’s a formula you can use to figure it out.

Generally, 1.5 cents per dollar spent is good value, 2 cents is amazing, and anything over that, you should book immediately.

Here’s the calculation you’ll need:

- Take the price to book in $, and minus taxes and fees to book with points

- Divide this number by the number of points needed to book

- Then multiply the total by 100

So, for an economy trip from London to New York, this would be:

- $400-278 = 122

- 122 divided by 20,000 = 0.0061

- Multiplied by 100 = 0.61

As you can see, this point redemption is pretty awful. Your points value is actually less than the 1x you tend to earn at. As a rule, economy flight redemptions are pretty bad.

With the same flight in first class, we have:

- $3,000-994 =2,006

- 2,006 divided by 95,000 = 0.021

- Multiplied by 100 = 2.1

Of course, as this is over 2 cents per dollar spent, it’s an amazing value. Even though you have to spend $994 in taxes and fees upfront, the points redemption brings the price down by over $2,000 versus buying outright.

Realistically, a decent annual fee-paying card with a good welcome bonus and a couple of the earning strategies above can get you to 95,000 points relatively quickly.

If you’re looking at economy flights, most of the time it’s better to just buy it on your credit card and get the extra points for your next trip. It’s rare that these flights are over 1.5 points per dollar spent, so it’s often worth saving up for the fees and taxes in the higher classes.

A Note On Taxes And Fees

While many influencers will say you’re getting free flights, it’s often not really the case. You’ll nearly always have to pay some taxes and fees.

However, some countries have higher taxes and fees than others. For instance, the UK is notoriously bad for having high fees, so I’d avoid flying to or from the UK to use your points.

Some great cities in Europe to travel to or from with lower taxes and fees include Oslo and Rome. Norway and Italy have relatively low taxes and fees on airlines, so this is a good way to get around the higher taxes in the UK, the Netherlands, or France, where most people tend to fly into.

When you buy an airline ticket, you’ll see the breakdown of the taxes, fees, and the actual ticket price. For economy tickets, it’s mostly taxes and fees.

That’s why the redemptions on economy tickets are so bad – there isn’t much that the airlines can actually take off with reward points.

My Top Credit Cards for Points and Rewards

Now that you know all about the different ways to earn and spend points, let me share a few

Capital One Business

First up, we have the Capital One Business cards. These change a lot, but the best option at the moment is the Venture X Business. This is obviously a business card, so the minimum spend for the welcome bonus is really high. However, if you run a business, this could be an option.

- Welcome Bonus: Earn 150,000 miles once you spend $30,000 in the first 3 months

- Annual Fee: $395

Perks

- Annual $300 credit for bookings through the Capital One Travel Portal

- 2x miles as standard for all purchases

- 5X on flights and 10X on hotels and rental cars booked through the Capital One Travel Portal

- You get 10,000 bonus miles every year, starting on your first anniversary

- TSA Pre-Check included

- Lounge access included

- Free employee and virtual cards

Capital One Personal Venture Card

If you’re not eligible for business options, check out the Capital One Personal Venture card.

- Welcome Bonus: Earn 75,000 miles once you spend $4,000 within the first 3 months

- Annual Fee: $95

Perks:

- Annual $300 credit for bookings through the Capital One Travel Portal

- 2x miles as standard for all purchases

- 5X on vacation rentals, hotels, and rental cars booked through the Capital One Travel Portal

Amex Business Platinum Credit Card

Next up, we have the American Express Business Platinum Credit Card. Amex is one of the biggest names in travel reward cards, so it’s little wonder that they’re in my top list.

- Welcome Bonus: Earn 200,000 points once you spend $20,000 in the first 3 months

- Annual Fee: $695

Perks:

- Receive $2,000 of statement credit across Dell, Indeed, Adobe, Hilton, and wireless technology and flight vouchers.

- Free lounge access

- 5x points on hotels and flights booked on the Amex travel portal

- 1.5x points on business categories and purchases over $5,000

- 1x points on everything else

- Fee credit for Global Entry or TSA PreCheck

- Gold status for both Marriott Bonvoy and Hilton Honors

Chase Sapphire Preferred

If you’re looking for a personal credit card with a relatively low annual fee, the Chase Sapphire Preferred is a perfect option. There are so many great category boosts to this card, which means you’ll get even more for your everyday spends.

- Welcome Bonus: 75,000 bonus points once you spend $5,000 in the first 3 months

- Annual Fee: $95

Perks:

- 5x points on Chase Travel

- 2x points on all other travel

- 3x points on dining worldwide

- 3x points on online grocery purchases, excluding Walmart, Target, and wholesale clubs

- 3x points on select streaming services

- 1x points on all other purchases

- $50 annual travel credit for hotel stays purchased through Chase Travel

- 10% anniversary boost each year: earn bonus points equal to 10% of your total purchases made the previous year. So, if you spend $25,000 in one year, you’ll get 2,500 bonus points in the next year.

Chase Sapphire Reserve

For an elite card that’s jam-packed with credit perks, check out the Chase Sapphire Reserve card. Note that the credit perks are paid in two halves throughout the year, and there are minimum night spends for the hotel-related credit perks.

- Welcome Bonus: 125,000 points once you spend $6,000 in the first 3 months

- Annual Fee: $795 + $195 per authorized user

Perks:

- 8x points on all purchases through Chase Travel

- 4x points on flights booked direct

- 4x points on hotels booked direct

- 3x points on dining worldwide

- 1x points on all other purchases

- $300 annual travel credit

- $500 travel credit for stays in The Edit collection

- IHG One Rewards Platinum Status

- Priority Pass membership for airport lounges

- Fee credit for Global Entry or TSA PreCheck

- DoorDash membership for one year

- $300 StubHub credit

- $300 dining credit for Sapphire Reserve Exclusive Tables restaurants

- Credit for Peloton, Apple TV, and Lyft

- $500 Southwest Airlines Chase Travel credit

Marriott Bonvoy Bevy® American Express® Card

If you’re more likely to spend money on hotels than flights, check out the Marriott Bonvoy Bevy® American Express® Card. You can also redeem points to rent a car, with over 40 airline partners.

- Welcome Bonus: 155,000 bonus Marriott Bonvoy® points once you spend $5,000 in the first 6 months

- Annual Fee: $250

Perks:

- 6x points on Marriott Bonvoy hotels

- 4x points at restaurants and U.S. supermarkets

- 2x per dollar for every other eligible purchase

- Earn 1,000 Marriott Bonvoy® bonus points per paid eligible stay booked directly with Marriott

- Earn 1 Free Night Award after spending $15,000 on eligible purchases on your Marriott Bonvoy Bevy® American Express® Card in a calendar year.

- Get Marriott Bonvoy® Gold Elite Status for free

- Earn 15 Elite Night Credits per calendar year

How to Access the Special Points Deals

So, now that you know all about the magical ways to earn points, how can you find the best deals to spend your points? This is critical for finding a good redemption rate, as with dynamic points pricing, it changes all the time.

Email Newsletters

First of all, you need to be signed up for your credit card provider’s email newsletter. This will tell you about any redemption bonuses or bonus point offers coming up on the horizon. This is the first place to look to see where your points can go further.

Portals

It’s old school, but literally just scanning your travel portal is a great way to spot any new deals. You can usually sort them from high to low in terms of points return and search by category. From here, you can set up an alert to see if they go up or down.

Reward Seat Finders

With the emergence of dynamic pricing for flights, many airlines have launched reward seat finders. For Virgin Atlantic, this is a simple month-view search that tells you the points price each way for economy, premium, and first class for their standard routes.

You’ll also see little red saver labels alongside the cheapest redemption options.

For Flying Blue, which is KLM and Air France’s joint loyalty plan, they have a range of reduced-point flights each month. The destination and routes change, so it’s worth being poised at the start of the month to see what discounted flights are going out.

Tools to Find the Cheapest Points Redemption Flights

While you can go old school and manually check the different airlines and your credit card portal for the price of point redemption flights, we’re all about efficiency. There are plenty of tools out there that help you find the best value options quickly and in a stress-free way.

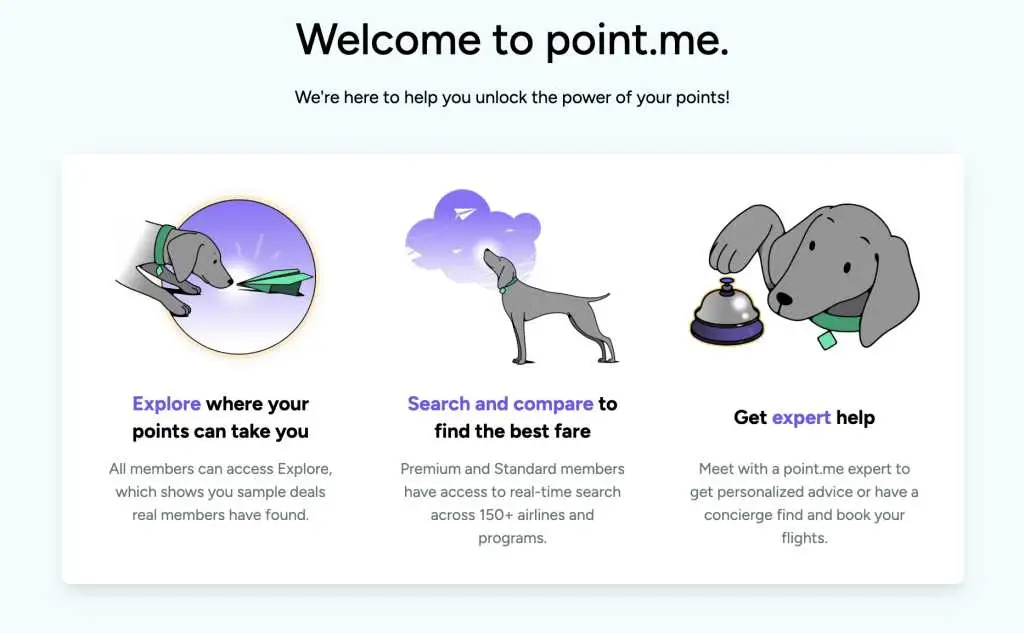

point.me

I cannot tell you how much I love point.me. If you only use one tool to find affordable point redemption flights, let it be this one. You can search for your flight route, and it’ll show you the different points needed for each airline and the taxes and fees.

You can directly compare which option is best for you. Some will have higher points requirements and lower taxes, and others will be the opposite. But it shows you the best option at a glance, so it saves you hours of searching manually.

You can filter it by which class ticket you’re looking for, and it often highlights particularly good deals. You can also save your home airport, and the email newsletter can send you personalized deals and updates.

If you’re not fixed to set dates, you can also use a whole month view to help find the cheapest dates to fly.

Skyscanner

While I use Skyscanner all the time to find cheap flights, I also use it to figure out if my points redemptions are worth it. Fundamental to our formula is the actual price of the flight if we were just going to pay out of pocket.

Skyscanner compares airlines, third-parties, and different routes to give you multiple options.

This also helps to show you the peak and off-peak times to fly, as you can quickly see the most expensive times to fly. If you’re not sure where to go, I’d also use the “everywhere” search feature to see what’s leaving from your home airport.

Once you have a rough idea, you can use point.me or Points Path to find the redemption options and see if it’s worth using your points.

Points Path

If you use Google Flights to find and track your flights, you need to know about Points Path. It’s a Google Chrome extension that works directly in Google Flights.

It shows you the different points and fee redemption options for each route, directly alongside the advertised price. This makes it really easy to work out if the redemption is worth it or not.

The only downside at the moment is that it’s mostly focused on US routes and airlines, so it doesn’t work on every search. However, here’s hoping that they expand worldwide soon, as this is such a useful tool to use alongside Google Flights’ price tracking features.

Vanessa Wachtmeister is a travel tech professional and the creator of the wealth & wanderlust platform, Wander Onwards. Vanessa is originally from Los Angeles, California, she is a proud Chicana, and she has been living abroad for the last 9 years. Today, she helps people pursue financial and location independence through her ‘Move Abroad’ Master Class, financial literacy digital products, and career workshops.