Welcome to my Pink Money Series! Just as companies rebrand ordinary objects into pink ‘women-friendly’ alternatives, the Pink Money Series is where I explain money information with feminine colors so women know ‘it’s for us.’ This week, we’re talking about budgeting for beginners based on a ‘zero-based budget’ methodology, where every dollar gets a job!

Budgeting for Beginners

Budgeting for beginners can be daunting. Budgeting was difficult for me at first because there was just SO MUCH information. No single app could hold all of my accounts AND data leaks/scraping is so common now – I hardly trust any online platform! So I built my own.

This tutorial is all about creating a ‘Zero-Based’ Budget; that means, by the end of the month, your budget should end at $0. It’s literally your responsibility to spend every last dollar…. but maybe not in the way you imagined.

What You’ll Need to Get Started

To get started, you’ll need to have the following with you:

- Income Statements: Payslips, bank statements, anything that tells you how much money is coming into your bank account

- Expenses: Debt and credit card statements, online banking, apps that track spending; anything that tells you how much money is leaving your bank account.

We’re going to track the cash flow in and out of your bank account to ensure you’re living beneath your means and hitting your financial #goals. This budgeting for beginners guide was formatted with normal people in mind. If something is confusing, just reach out on Instagram @WanderOnwards.

Beginner’s Budget Dashboard

Follow the tutorial with your own Beginner’s Budget Dashboard! This product tracks:

- Income (up to 5 streams!)

- Expenses & Bills

- Pre/Post-Tax Investments

- Debt Repayments

- Savings & Investments

- And more!

Establish your #GOALS

When budgeting for beginners (or anyone else for that matter), you need to make sure that your GOALS are clear. Before you do anything, you need a space where you write down all of your major expenses/categories of expenses and then, list what you hope to pay per month.

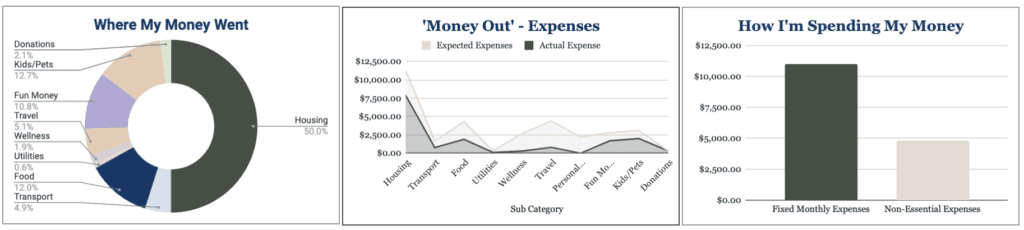

In my Beginner’s Budget Dashboard, the #GOALS section is all about the ideal budget you’d like to have. In a ‘perfect world’ this would be the perfect breakdown of your monthly income. This page depicts:

- What income you hope to have

- What bills you hope to pay & how much

- Debt repayment goals

- Pre & post tax investments

- Savings goals

Create Categories & Subcategories

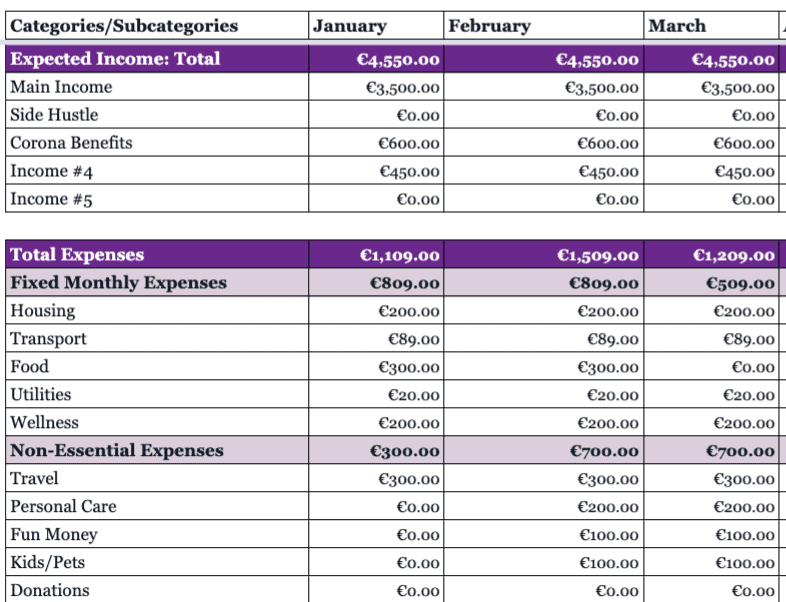

On your #GOALS page, be sure you create categories (example pictured below) and label each section. In my Beginner’s Budget Dashboard, I’ve created space for multiple streams of income, ‘fixed’ monthly expenses (things you HAVE to pay).

Then I have a ‘non-essential’ expenses section with things I could cut back on if necessary. This is the foundation for any budgeting for beginner’s practice so be sure you get this section right!

By month, I list out how much I hope to pay each month and I measure that against what I actually pay.

Money In: Income

Next, you need to track the money and flows in and out of your accounts. The ‘money in’ is called income and the ‘money out’ is called expenses. In a new sheet (on excel, Google Sheets, etc), start tracking your income and expenses on separate sheets for simplicity’s sake. (Photo from Dashboard)

When recording Income, be sure to record important details such as:

- Date

- Income Type

- Details (Item)

- Amount

Continue to record every payday for your main income (full-time job) and for any side hustles or supplementary income you might have. This could also include Corona Benefits (already listed), Childcare, or state benefits.

Money out: Expenses

In the ‘Expenses’ sheet, record your actual expenses for every month. An Expense is anything that makes money leave your account (i.e. you’ve spent it). Have a look at your bank statements and receipts for help with this. Be sure you include the dates of each purchase so you can evaluate monthly trends in your spending.

To keep things simple, I’ve organized purchases by subcategories and there’s an additional section for details (items) in my Beginner’s Budget Dashboard. In the Expenses (Input) sheet, I’ve created ‘themes’ for you under each pre-filled category. You can create your own and then add details about your purchase under ‘Item.’

Expense Hack

If you’re recording hundreds of expenses from the past, your mobile banking app can help with this! More often than not, your mobile banking app will have statistics about how much you’ve spent over the month, which are then grouped by category.

Instead of recording hundreds of individual purchases (like a Starbucks Coffee on February 2, 2020), use these categories to record past spending in the Beginners Budget Dashboard subcategory section.

For example, based on the spending information in the mobile banking screenshot (below), you would record ‘Shopping’ on August 1st for a total of $162.50 under the subcategory ‘Fun Money.’ This is much easier than recording each little purchase throughout the month of August.

Investing and Savings

If you’re just starting to create your own budget, start with tracking income and expenses first. Let’s call this ‘Level 1’ Budgeting for Beginners. Once you get the hang of things, move on to tracking Investing and Savings!

There are two main types of investment bucks that you should track because they potentially impact your income/tax situation in different ways than regular income. The two main types of investment categories are:

- Pre-tax investments

- Post-tax investments

Pre-Tax Investments are accounts that are filled with money that hasn’t yet been taxed by the government. This would include retirement plans (401k, 403b, Pensions, etc) and these are ‘tax advantageous’ because it lowers your taxable income.

Post-tax Investments are accounts filled with money that has been taxed by the government. On payday, the money that is in your account has likely already been taxed by the government. You get to choose how/where you invest that money – which can include: a Roth IRA, ISAs (UK), normal stock brokerages, etc.

Be sure to change the categories that are specific to you! Not everyone has a 401k.

Debt Repayment

Debt is complicated. Because of interest rates, it’s hard to accurately and completely measure how much you’ve paid down unless you have a specialized formula. If you’re creating your own budget format, it might be worth downloading a free debt resource from NerdWallet that can track debt and interest repayment.

In the Beginner’s Budgeting Dashboard, you can track how much you hope to pay each month [in #Goals] against how much you’ve actually paid down in Debt (pictured above).

Like in the other examples, all you need to do is record a debt payment date, which debt it was paid to, and how much.

Free Dashboard Video Tutorial

If you’re interested in finding out more about my Beginner’s Budget Dashboard and how it works, check out this free tutorial on Youtube!

Conclusion

Thanks for your interest in my Beginner’s Budget Dashboard! I hope this has made budgeting for beginners a lot less scary.

Don’t forget to check out my financial tools for beginners on Youtube!

Read More Expat Money Tips:

- 11 Creative Ways to Cut Down How Much You Spend

- Gen-Z Money Tips

- 6 Easy Ways to Save Money for Travel

- Beginner Investment Apps for the UK & US

- Women: Should You Start Investing?

- Review of MyExpatTaxes

Vanessa Wachtmeister is a travel tech professional and the creator of the wealth & wanderlust platform, Wander Onwards. Vanessa is originally from Los Angeles, California, she is a proud Chicana, and she has been living abroad for the last 9 years. Today, she helps people pursue financial and location independence through her ‘Move Abroad’ Master Class, financial literacy digital products, and career workshops.